The Importance of Long-Term Budget Planning for Nonprofits

- Amber Parker

- Jul 29, 2025

- 3 min read

When you’re steering a nonprofit organization, the future can feel like a foggy horizon, unpredictable, full of both opportunities and challenges. That’s why long-term budget planning isn’t just a financial exercise; it’s a strategic imperative. It aligns resources with mission priorities, prevents financial crises, and provides clarity for both staff and board members. Without it, even the most passionate and impactful nonprofits can stumble.

I’m in the middle of this work right now for Ijams Nature Center. We’re developing a five-year pro forma for our Early Learning Programs. This is a deep dive into whether expanding our classrooms to two would be financially viable. (Spoiler alert: it is.) This isn’t just about numbers; it’s about charting a path that lets us expand impact while staying fiscally sound.

Alongside that, we’re creating a five-year pro forma for the entire organization. This document will help us understand when we’ll need to bring on additional staff and how we can do so responsibly. Creating these tools has already sparked what one of my colleagues affectionately calls “spicy dialogue” among staff, honest, forward-thinking conversations that challenge assumptions and push us toward clarity and growth.

Why Long-Term Budget Planning Matters

It Aligns Financial Resources with Mission Goals A nonprofit’s mission is its compass. Without long-term planning, it’s easy to drift, reacting to immediate needs rather than proactively steering toward larger goals. Forecasting lets you ask, What will we need financially to achieve the next five years of impact?

It Provides Stability and Safety Staff and board members need to feel secure to perform at their best. A well-constructed annual budget combined with a multi-year forecast provides a roadmap, reducing uncertainty and removing unpleasant surprises.

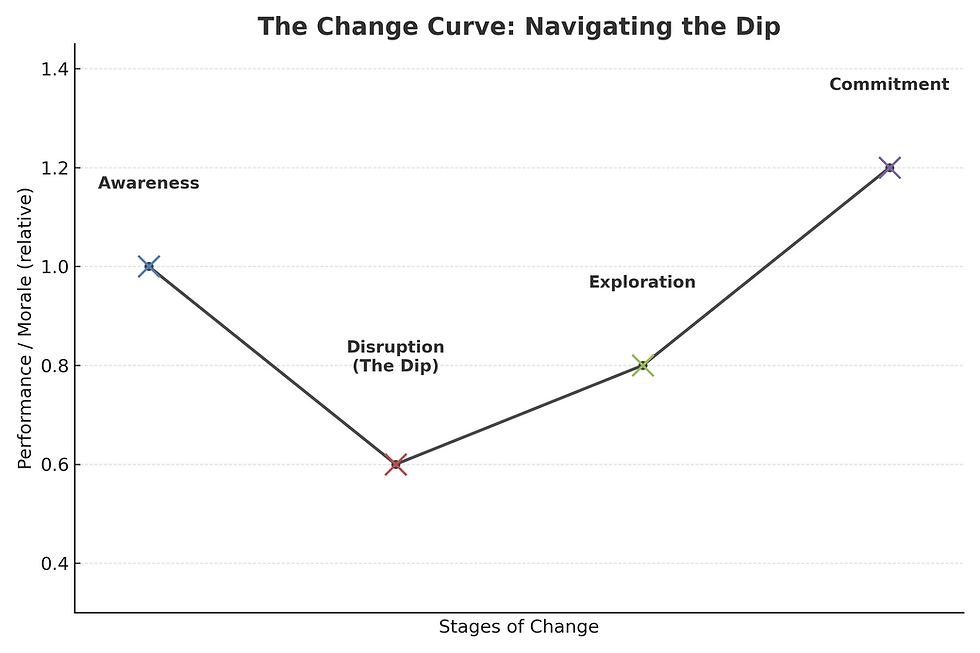

It Equips the Organization for Change Economic downturns, shifts in donor behavior, or sudden crises can put immense pressure on a nonprofit. Long-term financial forecasting gives organizations a buffer, an understanding of their financial elasticity, so that they can adapt with less panic.

It Strengthens Board Engagement Pro formas and forecasts aren’t just numbers; they’re conversation starters. They allow board members to ask thoughtful questions, test assumptions, and better understand the vision for growth. When a board sees five years ahead, they can make decisions today with confidence.

It Sparks Strategic Dialogue As I’ve seen at Ijams, creating these documents encourages collaboration and creative problem-solving among staff. Financial planning becomes less about "what we can afford" and more about "what’s possible, and how do we get there?"

It Builds Donor Confidence Donors and funders want to invest in organizations that have a plan, not just for the present but for the future. Being able to show a five-year path to sustainability can strengthen grant applications and major gift conversations.

Methods for Long-Term Financial Forecasting

1. Build on a Strong Annual Budget. Your annual budget is your baseline. It should be detailed, realistic, and built collaboratively. A weak annual budget will make long-term forecasting feel like guesswork.

2. Use Pro Forma Statements. A pro forma is essentially a financial “what-if” scenario, projecting revenues, expenses, and cash flow under various assumptions. At Ijams, we’re using a pro forma to model the impact of expanding classrooms and hiring additional staff, which is helping us understand not just if we can grow, but when.

3. Plan for Multiple Scenarios. Don’t just forecast the best case. Include conservative and moderate projections, factoring in fluctuations in funding, program revenue, or economic conditions.

4. Tie Forecasting to Strategic Goals. Long-term financial planning isn’t just about survival; it’s about thriving. Link your numbers to strategic objectives so the forecast becomes a narrative about where your organization is headed.

5. Revisit and Revise. A forecast isn’t static. You will need to review and adjust it annually (or more frequently, if needed) to reflect changes in programs, funding, or external factors.

Looking Forward Together

Combining a robust, well-constructed annual budget with a thoughtful five-year pro forma does more than prepare your nonprofit for the future. It shapes it. It removes unnecessary surprises, provides structure for yearly planning, and equips your organization to weather crises and seize opportunities.

Most importantly, it helps your team see beyond the present. A nonprofit’s staff and board need to feel grounded, safe, and clear on where they’re headed. Long-term financial forecasting offers that clarity, allowing everyone to work confidently toward the mission.

Comments